A DeFi lending and

borrowing ecosystem

powered by Real-World Assets

A DeFi lending and

borrowing ecosystem

powered by Real-World Assets

RAAC builds stablecoins backed by precious metals

and facilitates on-chain borrowing against real-estate,

capital markets, and more.

RAAC builds stablecoins backed by precious metals

and facilitates on-chain borrowing against real-estate,

capital markets, and more.

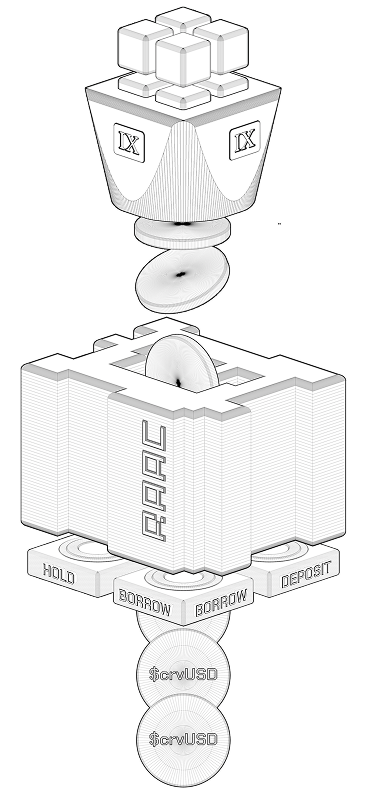

01RAACLend

Tokenized real-estate that can be deposit into lending pools or borrow against.

REAL ESTATE ASSET

FEED INTO

INSTRUXI

TOKENIZATION ENGINE

TRANSFORM THEM INTO

TOKENIZED RWA

NFT

RAAC

THE NFTs ARE USED AS

COLLATERAL IN THE BORROWING

AND LENDING ENGINE

COLLATERAL IN THE BORROWING

AND LENDING ENGINE

$CRVUSD

Coming Soon

Total Value Locked

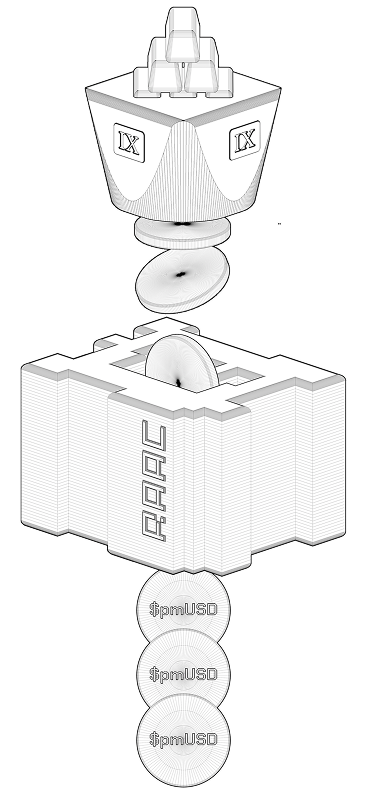

02RWf(x)

Tokenized RWAs are used as collateral to mint stablecoins, then deployed for yield.

GOLD & COMMODITIES

FEED INTO

INSTRUXI

TOKENIZATION ENGINE

TRANSFORM THEM INTO

TOKENIZED GOLD

ERC-20

RAAC

THE ERC-20 ARE USED AS

COLLATERAL (CDP) TO MINT

STABLECOINS

COLLATERAL (CDP) TO MINT

STABLECOINS

$PMUSD

Who is RAAC for?

01

Commodity Investors

Access on-chain markets with ease. RAAC provides built-in distribution, liquidity, and yield bearing products within DeFi.

02

Structured Liquidity

We deploy liquidity in structured products helping your protocol scale.

03

DeFi

Earn competitive yield while diversifying ones portfolio with real-world assets.

Pillars of RAAC

RAAC is a decentralized lending and borrowing ecosystem that is widening

participation in tokenized Real World Assets

Ecosystem &

Advisors

Frequently

Asked

Questions

Key information on how RAAC works and

how you can benefit from stable RWAs.

RAAC is a DeFi lending and borrowing ecosystem that opens up participation in tokenized real-world assets for everyone.

We are scaling DeFi with uncorrelated collateral types and yield generated by real-world assets. This means bolstering overall liquidity for the DeFi ecosystem, while allowing institutions the opportunity to earn more yield on their otherwise static assets. We've merged and ultimately created a win-win for decentralized and traditional finance.

RAAC offers two core products: RWf(x) | We build and deploy stablecoins backed by commodities (e.g., $pmUSD). RAACLend | We facilitate on-chain borrowing against real estate, capital markets, and more via NFTs, allowing users to have access to low-volatility assets in DeFi while borrowing and earning against them.

Asset Issuers | Institutions, mining companies, and organizations that have commodities or assets they'd like to deploy on-chain to earn asymmetric yield. DeFi Protocols | Those that need USD inventory to scale their protocol. DeFi Users | Anyone who wants to participate in the RAAC ecosystem and earn yield with uncorrelated and sustainable RWA collateral-backed yield products.

RAAC's first stablecoin in the RWf(x) protocol suite is $pmUSD. It's backed by gold and pegged to the USD. It's the original "gold-backed dollar" but just brought on-chain—a safer and more stable collateral than the alternative fiat- or fund-backed stablecoins in DeFi.

RAACLend is a standalone protocol built to allow users to borrow and lend RWAs permissionlessly. We tokenize real-estate for users as NFTs, and allow them to do what they wish with it. They can just hold and keep the rental income, deposit it into a pool as LP to earn more fees or borrow crvUSD against it.

Dive into the protocol documentation here or reach out to us on Twitter.

Copyright 2025 - RAAC Advisory All Rights Reserved